comparison of best car loan offer by indian banks

Comparison of Best Car Loan

due to the covid 19 pandemic, the need to own a car has achieved greater significance. if you want to buy a car, many banks offer car loans; choosing the right one for you would require some research and comparison.

factors to compare car loans

there is no universal best car loan as one size does not fit all. you can choose to borrow from a bank that offers a loan that suits you best. some of the factors that you should focus on when comparing car loans are as follows:

1. interest rate

the interest rate is one of the most crucial factors when comparing loans offered by various banks. the rates vary across lenders and may also vary depending on the customer profile.

2. loan tenure

when comparing loans, look at the loan tenure as it impacts the equated monthly instalment (emi). a shorter-term would mean bigger emi but overall lower interest cost. a longer-term would result in smaller emis and a larger interest burden. use a car loan emi calculator to ascertain your monthly outflow and if you will easily be able to pay the amount easily.

3. processing fee

the processing fee is not a large amount that you have to pay, but it varies across lenders. it makes sense to factor in this aspect when comparing car loans. small additional expenses add up to the overall cost of borrowing.

4. ltv ratio

when you take a car loan, the lender will give you a proportion of the car value as a loan. the rest has to be paid upfront by you; this is known as the loan to value (ltv) ratio. if you have not saved enough for the down payment, you should consider lenders who offer a higher ltv ratio. however, if you have saved a sufficient amount, then your choice of lenders is wider. using a car loan eligibility calculator can help you decide how much you need to pay as a down payment and the amount you can get a loan.

5. ease of processing

look for banks that require minimal documentation and offer quick and simple loan processing to ensure faster and hassle-free loan processing.

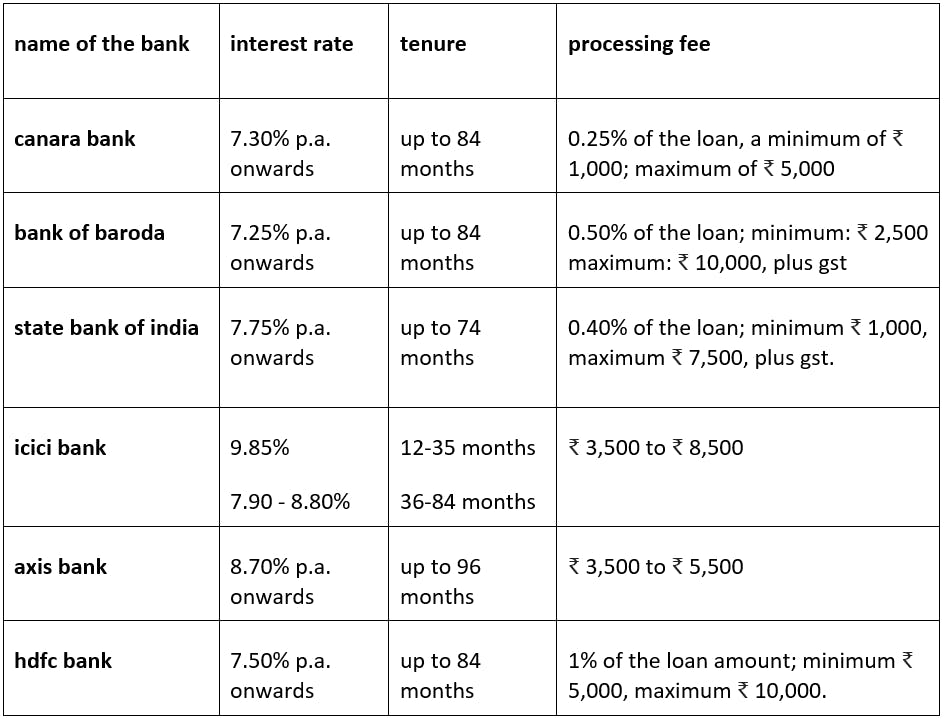

the table below gives a quick comparison of some car loan offers by banks:

conclusion:

choose a loan that suits you best based on the comparison based on the above aspects. you can use a car loan calculator to check your loan eligibility and also your emi burden. using a car loan calculator will help in comparing loan offers by different banks.