emi calculator

as of march 2020, personal loans in total bank credit stood at 24%, recording a 7.4% jump since march 2015. this statistic corroborates market sentiments of personal loan gaining nationwide prominence.

personal loans are unsecured loans granted to satisfy personal needs such as fulfilling children's higher education costs, buying a home, or something else.

these loans are sanctioned after a careful analysis of the borrower's income level, payment histories, and repayment capacity. these loans allow the borrower to make emi, i.e. equated monthly installments payments.

as the term suggests, they are fixed amounts calculated on the principal and interest that are payable by the borrower on a fixed calendar date every month.

while a personal loan can help you survive a monetary emergency in a pinch, it is not worth drowning in debt over this type of credit.

hence, it's important to familiarise yourself with the nitty-gritty of the loan and the repayment procedure. this is where the role of an emi calculator comes into play.

what is emi calculator?

an emi calculator is an online calculator used in the calculation of loan emi for the loan repayment. it allows you to calculate the emi rate for any loan, be it a car, home, or personal loan. the calculated emi has two components –

- principal amount

- interest amount

the formula to calculate emi is -

pr(1+r)n(1+r)n-1

where,

p - principal amount,

r - interest rate,

n - loan tenure.

how does this calculator work?

one can access this calculator on the internet by visiting the website portals of different lending players. the calculator requires the user to punch in different values, like:

- required loan amount

- tenure, i.e. the number of years in which you intend to repay the entire loan

- interest rate

bear in mind that most banks offer personal loans for a maximum period of 5 years. the calculators are designed in this fashion, such that entering a value above 5 prompts the user to change their input.

once you enter your values, the calculator displays three crucial figures:

- total principal amount

- total interest payable

- emi amount

this way, you can figure out the accurate values of your emi payments, that too in a fraction of the time it normally takes to calculate these numbers manually.

how can you use this calculator?

it's pretty simple to access and understand this calculator's workings. the tool works in the same way as a regular calculator. all you're required to do is:

- open the website

- launch the calculator

- plugin the values using the slider or manually punch in numbers

- hit submit

the calculator will immediately display the emi against your loan amount in the form of a table and a colourful pie chart or a bar chart.

why is it important for you?

a personal loan can get messy. since the loan gets customised to suit your needs and capability and involves no collateral, it's crucial to stay updated at each stage of this process.

this emi calculator helps you achieve better financial planning. by plugging in your desired values, you get a good idea of what's in store for you after the loan is approved.

moreover, loan calculations may get messy and complex. with one simple click, you have early access to information that otherwise channelises your energy into unproductive tasks.

calculating your emi online: an example

the calculator uses the following formula to generate results:

emi = [p x r x (1+r) ^ n] / [(1 + r) ^ (n - 1)]

where

emi = equated monthly payments

p = principal amount

r = interest rate

n = tenure

let's assume person x is seeking a personal loan worth ₹ 18,00,000. he intends to repay this back in 5 years (60 months) at an interest rate of 12% per annum.

punching these numbers into the formula gives:

emi = [1800000 x 0.12 x (1+0.12)^5] / [(1 + 0.12)^4]

thus, the emi value equals to ₹ 41,883.

- total principal = ₹ 18,00,000

- interest payable = ₹ 7,12,971

- total amount payable = ₹ 25,12,971

advantages of using an emi calculator

by now, we hope your intuition points to the numerous advantages presented by an emi calculator. let's decode them here:

1. good financial health

repaying loans can get challenging. inadequate information, on top of this, just worsens the situation.

however, to strike balanced financial health, you need to stay updated about the loan market - while at the same time, honestly assess your capabilities to fulfil them.

this calculator helps you with information at your disposal. the emi calculator presents the entire breakup of the instalments expected from your end.

this way, you can gauge your capability and make an informed decision.

2. no room for ambiguity

most calculators present answers to the nearest degree. the emi calculator is an exception, though.

the calculator presents a precise answer to the last digit. therefore, the stress of experiencing increased repayment values or anything along such lines is out of scope in the future.

3. free access

this online tool is available for free on the website portals of the lending banks. there is no limit to the number of free calculations. one can get going until they find the emi number that suits their financial health.

4. keeps you safe

often, people end up becoming victims to the nastiness of market movements. however, this nastiness does not exist when you stay updated with the aid of emi calculators.

as warren buffet rightly pointed out, "risk comes from not knowing what you're doing." while this has been quoted in a stock market context, it applies equally well to the personal loan subject.

what are the effects of loan prepayment on emi?

prepayment is a choice provided by the banks, which allows you to pay your loan before the loan tenure. with prepayment, you do have considerable savings.

if you are seeking a personal loan for ₹ 2,00,000 at 14% for 5 years, provided, the prepayment penalty is 5%, and 1 year is the lock-in period. so the calculation will be -

prepayment after 1 year (in ₹) | prepayment after 3 years (in ₹) | |

|---|---|---|

loan amount | 2,00,000 | 2,00,000 |

interest | 79,219 | 79,219 |

emi | 4,654 | 4,654 |

principal (outstanding) | 1,70,298 | 96,925 |

interest (outstanding) | 53,077 | 14,763 |

5% penalty | 8,515 | 4,846 |

savings | 44,562 | 9,917 |

the table clearly shows how prepayment can help you save a huge amount.

what are the factors that affect loan emi?

emi (equated monthly installment) is the amount that a borrower pays every month to the lender against his/her loan. there are 3 key factors that affect the emi rate of your loan, which are -

- the principal amount as the loan interest is calculated based on the amount you borrowed.

- the interest rate of your loan at which the bank or private lender has offered you the loan.

- your loan tenure is also a major factor that affects loan emi as the interest is calculated on the loan tenure and principal amount both.

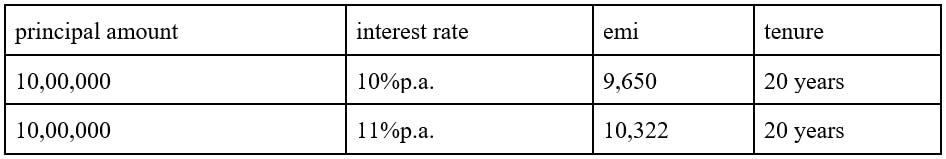

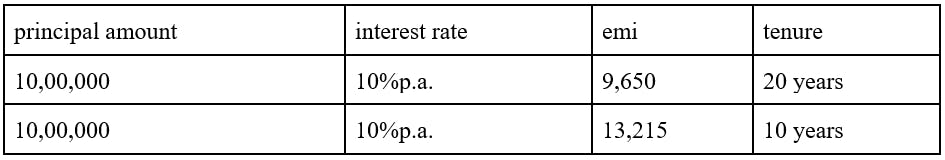

the table below shows the emi calculation of a loan of 10 lakh in different cases -

1. when interest rates are different

2. when loan tenure is different

concluding words

a personal loan and an emi work wonders if you are hesitant to pledge in your assets. that said, it is equally important to be vigilant and an honest borrower, who pays back every rupee on time.

in the midst of acquiring a personal loan, emi calculators are the way-to-go for maintaining a healthy financial lifestyle. make them your best friend to avoid unexpected troubles.

emi faq’s

what does emi mean?

equated monthly installment or emi is the amount that a borrower pays every month to the lender against his/her loan.

how can i calculate my loan emi?

you can use the emi calculator formula to calculate your emi.

emi = pr(1+r)n(1+r)n-1

p = principle amount

r = interest rate

n = loan tenure

does the emi cost change?

yes. the emi rate changes if it is a floating loan. however, in the fixed-rate loan, emi remains constant.

what does pre-emi mean?

it is the monthly payment of interest component only. it excludes the principal amount.

how does the loan tenure affect emi?

the longer the tenure, the smaller is the cost of emi.