ppf calculator

public provident fund (ppf), launched by the government of india in 1968, is a tax-deductible, low-risk saving scheme.

it is a means for converting small savings to long-term investments that provide retirement benefits to self-employed persons.

government saving schemes like ppf in india are quite popular. a survey conducted by nielsen revealed that saving and investing in the asia-pacific led globally at 61% and 37% respectively.

the ppf interest rate is 7.1% in 2020-21, and the minimum lock-in period is 15 years.

a significant advantage of ppf investments is that you can take loans against your account for expenses like a marriage or educational costs for a child.

how does the ppf calculator work?

if you have a ppf account, you would be interested to know how much principal and interest has accrued after a certain number of years.

previously, the calculation used to be complicated, and you would need an accountant to show you the figures.

the ppf calculator does the work of several calculations in an instant. fluctuating interest rates, which are revised every three months, are considered. it does the computation based on the information you provide.

the time of the year you invest is also critical. the interest for the financial year is calculated on the amount invested before the 5th of each month.

if deposits are made after the 5th, the interest will be less, and the calculator will compute accordingly.

how can you use this calculator?

you can get the ppf calculator in different modes. some of the modes that you may come across are:

- fixed annual amount

- fixed monthly amount

- variable annual amount

- variable monthly amount

each mode has a particular outcome depending on your individual scenario. here are the possible results for each calculation mode:

fixed annual amount

the calculator calculates the amount that you are likely to earn if you invest a particular amount on an annual basis for 15 years.

fixed monthly amount

the calculator will throw up a quick estimate on the amount that will be accrued from investing a monthly fixed amount for 15 years.

variable annual amount

here, you can see the amount you will earn if you invest different amounts every year – the calculator will also show you projected rates of interest for the future.

variable monthly amount

the variable monthly amount mode involves the most complicated calculations of all the modes. you can add random monthly amounts to reach a final figure at the end of a 15-year term.

what is the formula to calculate ppf?

you can use a ppf maturity calculator to calculate your ppf instantly. the formula to calculate ppf is -

a = p((1+i)n - 1i

where,

a = maturity amount

p = principal amount

i = interest rate

n = tenure

example of a typical ppf calculation

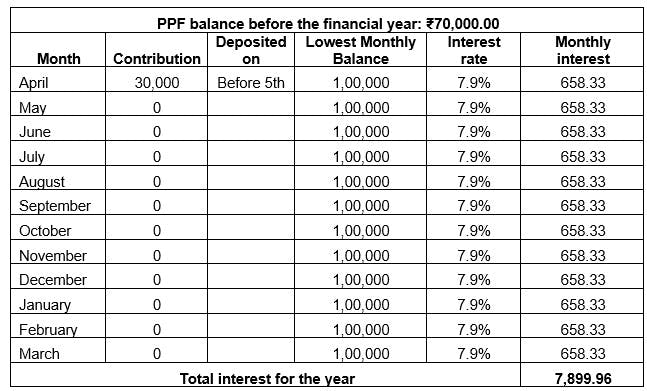

an amount of ₹30,000.00 was invested before the 5 april 2020. the previous balance was ₹70,000.00. the lowest monthly balance for the year would be ₹100,000.00.

the monthly interest @ 7.1% (the interest rate for january to march 2020) would then be ₹658.33. see the chart below:

the importance of a ppf calculator

an online ppf calculator is the quickest and most convenient way of calculating your ppf interest accrual and amount on maturity.

you don’t need to install dedicated software on your laptop, pc or handheld devices – open the webpage and use it. the platform also offers the latest updates to keep you abreast of the trends.

you may start by investing in a particular pattern, like say, monthly contributions, or consider switching to annual contributions after a few years. the online ppf calculator will give you all the information you need.

another benefit of these online calculators is that the results are often graphically represented. easily-readable chats and summaries will give you a clearer picture of what is happening with your money.

using a ppf calculator is crucial because it saves you from having to consult an accountant or spend time manually calculating your projected income from your provident fund.

tax benefit of ppf investments

the ppf amount calculated using the ppf return calculator has the following tax benefits as per it, act 1961 -

- you can claim deductions under section 80c of it act 1961, for the ppf deposits. u/s 80c, ₹ 1,50,000 is the maximum allowed deduction one can claim per year; provided all investments are inclusive of such claims.

- apart from 80c, ppf interests are also tax-free. even ppf proceeds and accounts are not applicable to wealth tax.

why invest in ppf?

public provident fund is a long-term tax-free investment scheme from the goi. this investment is good for beginners in the long term because,

- being a government instrument, it is risk-free.

- no tax on ppf interest calculated using ppf return calculator.

- unlike other instruments, the return in ppf is not influenced or dependent on the market.

- has partial withdrawal and loan facilities.

- tax benefits for ppf deposit under sec. 80c, it act 1961.

the ppf return calculations often get complex; therefore, you can use the ppf calculator to calculate. the ppf maturity calculator is a handy online tool that allows you to calculate your ppf return and interest instantly.

important points -

- the minimum investment an individual can make is ₹500 while ₹1,50,000 is the maximum limit.

- any individual or guardian (for minor) is eligible for ppf; however, hindu undivided family (huf) and nris are not eligible.

- an individual can open only one account in their name.

ppf faqs

what is ppf?

public provident fund is a long-term tax-free investment scheme from the government of india.

what is the eligibility criteria to open a ppf account?

any individual or guardian (for minor) is eligible; however, 1 individual can open only 1 account in their name.

hindu undivided family (huf) and nris are not eligible.

how can i calculate my ppf amount?

you can use the ppf maturity calculator to calculate your return.

what is the ppf calculator?

the ppf return calculator is a handy online tool that allows you to calculate your ppf return and interest instantly.

what is the investment limit in ppf?

minimum - ₹500

maximum - ₹1,50,000