Concor promises smooth sailing

Concor promises smooth sailing

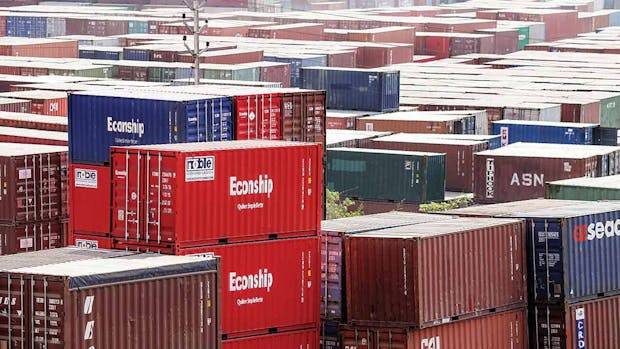

remember the Ever Given? the transport ship that was stuck in the Suez Canal for nearly a week in March, causing a traffic jam of sorts and inspiring millions of memes on the internet? well, turns out that didn’t stop the Suez Canal from raking in record revenues for 2021. authorities declared that around 1.27 billion tons of cargo were shipped through the canal, earning $6.3 billion dollars in transit fees, a 13% jump over the previous year and the highest ever recorded. this exemplifies the rise in prominence of the global supply chain industry under the squeeze of the pandemic.

despite the sector being dominated by a handful of large players, there is an opportunity for the retail investor to profit from this boom.

steaming ahead

that opportunity is the Container Corporation of India (aka Concor) which has been an outperformer on the markets of late. for 2021, it returned gains of over 51% against the ~31% delivered by the Sensex. there are two main factors behind this.

the first is a strong improvement in its quarterly results. for the latest reported quarter (July to September 2021), it delivered a 21% YoY rise in revenue to Rs 1,820 crore. this translates to a healthy EBITDA (earnings before interest, tax, debt, amortisation) of Rs 430 crore and a net profit of Rs 264 crore. this is a remarkable bounce from the lows of Q4 FY21 (January to March 2021) wherein it had only managed a net profit of around Rs 16 crore due to multiple issues plaguing the global supply chain.

opening the floodgates

the second reason is that Concor is one of the government’s divestment targets. it currently holds over 54% stake in the company, but will seek to reduce its holdings despite the setback to its plans of doing so within FY22. this infusion of capital should only help the firm with its ambitious expansion plans.

the government is also setting up dedicated freight corridors which will lead to an increase in the movement of goods, which in turn will lead to an increased demand for containers. the global shipping container market was estimated to be worth around $14 billion in 2020, and is expected to grow at a CAGR of 6% to reach $20 billion by 2026.

Concor is a relative minnow in the seas, but with increased focus on the sector from the government and costs projected to steadily increase, it’s likely to grow faster than the established players. besides, with the prominence of the railway goods transport network in India, it offers a great opportunity to bet on the biggest fish in the pond.