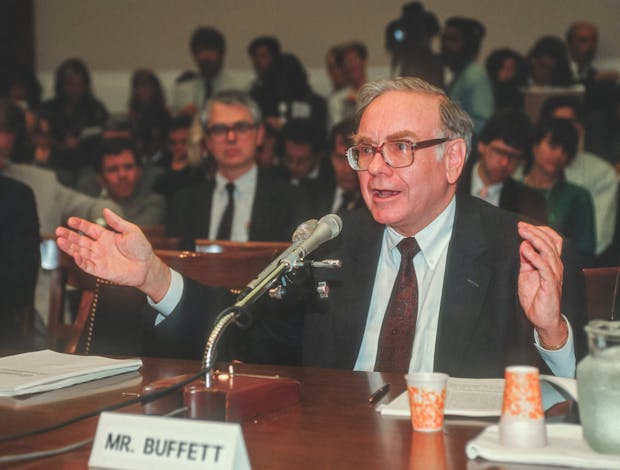

how Warren Buffett and his magic works

how Warren Buffett and his magic works

rule no. 1: never lose money. rule no. 2: never forget rule no.1.

it is probably the most popular thing that Warren Buffet has said. this and that his favourite holding period is forever.

but there is more nuance to Buffet than just these catchphrases. after all, you don’t get to a net worth of over $100 billion with just that.

to understand how Buffett did it, it is important to understand who Buffett is. Buffett’s claim to fame has been finding diamonds in the rough. his thesis has been on identifying undervalued stocks and doubling down on them. some of his earlier investments identify how he managed to do it. just a few examples of his earliest bets: The Washington Post, Coca Cola, Walmart, and Gillette. he is not in favour of diversifying his stock options to reduce the risk either. or like he puts it, “risk comes from not knowing what you are doing.”

how did he find these sure things? his letter to his shareholders in 1976 holds some clues. in it he said he would invest in very few companies but invest in them with the same due diligence as if he was acquiring the entire company. he would look at four major factors while choosing his investments.

1) favourable long-term economic characteristics.

2) competent and honest management.

3) the purchase price should be attractive when measured against the value to a private owner.

4) a familiar industry in which he would feel competent to judge the performance of the company.

this is where some of Buffet’s magic lies. understand the sector, understand the company, and be aware of the economic climate.

but this is hard. even the Oracle of Omaha (as he is popularly known) has gotten things wrong. remember his rule no. 1? during the 2008 financial crisis he personally lost around $25 billion. but he has made all of it back, and all he did was follow the same principles. it boils down to patience and courage. in Buffett’s own words, “the stock market is designed to transfer money from the active to the patient.”