India’s Thrasios Will Reshape Brands

India’s Thrasios Will Reshape Brands

let’s say you launch a kickass consumer product in the market. unique yet affordable. sales pick up and the brand grows. What’s next?

several direct-to-consumer (D2C) brands don’t have the answer to this question. yes, they have established a business model and earned revenues. but scaling is a conundrum. and that is where the Thrasio model is coming to the rescue.

simply speaking, the Thrasio model means a super-brand that houses several brands. named after the US-based Thrasio that acquires private labels, third party Amazon sellers, this model has become popular in the country.

India’s largest retailer Reliance Retail, for instance, is becoming a house of brands. so far, it has acquired a majority stake in boutique design studio Abraham and Thakore, purchased lingerie brand Clovia, bought a stake in designer brands such as Manish Malhotra and Ritu Kumar among others.

with over 600 D2C brands and counting, there is an exploding opportunity. Avendus said that this space is expected to grow to $100 billion by 2025.

side-by-side, the Thrasio specialists exist too. companies such as Mensa Brands, GlobalBees, 10Club are on a prowl to identify scalable ventures, acquire, and transform them into billion-dollar enterprises. amidst this, the original Thrasio has already made its India entry.

the roll-up strategy

the story begins in Massachusetts, United States in 2018. Carlos Cashman and Josh Silberstein shopped a lot on Amazon. they noticed that while a lot of unknown brands selling products on Amazon were highly rated, their growth looked stagnant. the duo wondered if there was a way to handhold these entities, provide finance and marketing, prevent them from shutting down, and make them grow sustainably. Thrasio and its roll-up commerce were thus born.

roll-up involves identifying online D2C brands that are successful and bringing them together under one umbrella. the brand is ‘rolled-up’ and taken to the Thrasio firm.

this is a win-win for brands that have already touched a certain milestone in the business. typically, companies with annual revenues upwards of $1 million are under consideration as acquisition targets.

here is Thrasio explaining what they do:-

Thrasio: One of The Most Efficient Aggregators of Amazon FBA Brands

in January 2022, the original roll-up giant Thrasio officially entered India by acquiring consumer brand Lifelong Online. Thrasio is also investing $500 million in India to grow its presence here.

but tough competition awaits. one-year-old Mensa Brands has already acquired over half a dozen D2C brands to help them scale. home-storage startup Pretty Krafts is the latest such partnership signed by Mensa.

Rival GlobalBees is racing ahead with 11 acquisitions so far, ranging from The Butternut Company, sustainable clothing brand Mush, jewellery brand Yellow Chimes, to eyewear brand Intellilens.

instead of setting up brands from scratch, for Thrasio-style firms, it makes business sense to acquire already established brands. these young brands have a strong presence among the younger generation with higher recall.

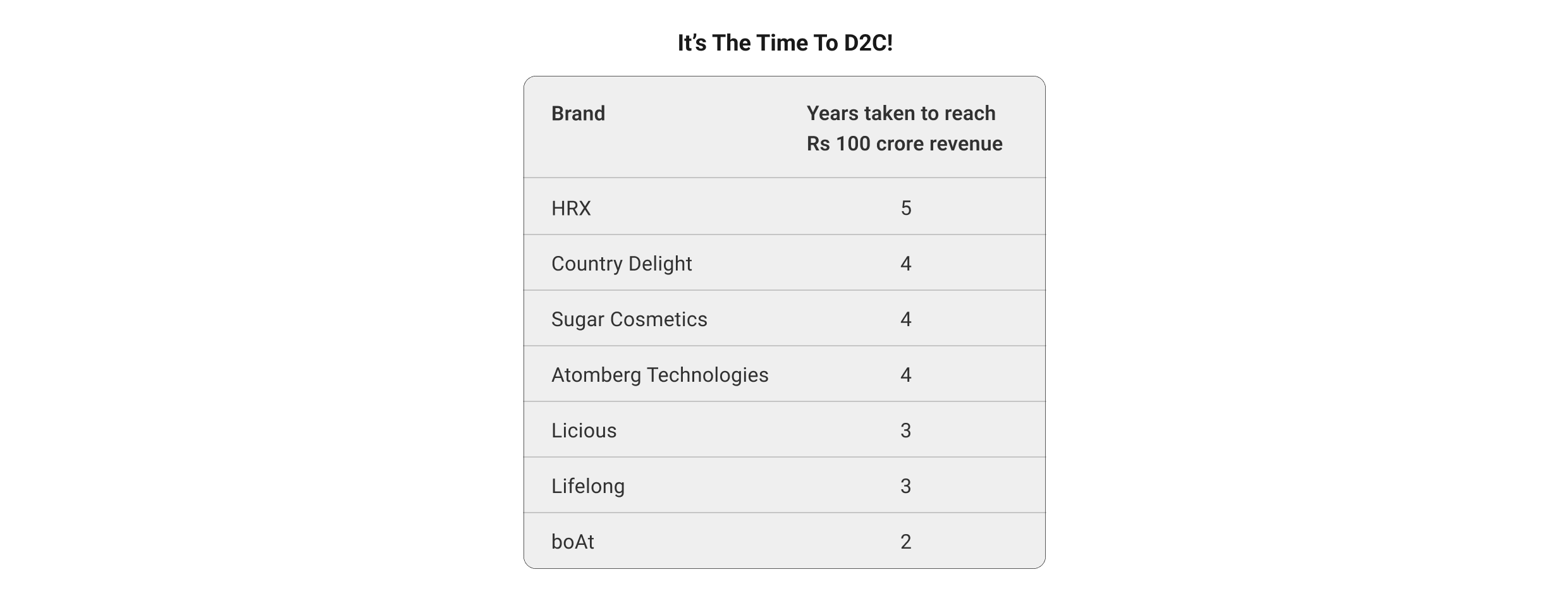

what makes these brands tick is that the revenue run-rate has been far superior to the big brands.

Sennheiser took nine years to touch a $13 million (Rs 100 crore) revenue. boAt took just two years to reach that milestone. Revlon took 20 years to cross $13 million while Mamaearth just took three years.

as the number of D2C brands explodes, the entities operating in the Thrasio space have bigger ambitions. for instance, 10club has set a target of acquiring 20 brands in 2022. here, 10club offers incentives to the entrepreneurs to stay back and grow the business after acquisition.

the club is getting bigger

it is a make-or-break moment in the Indian consumer goods market. players who make the first move gain.

for this very reason, large conglomerates such as RIL, ITC, and Aditya Birla are also not shying away from making an entry into the Thrasio-style business.

Reliance Industries is already on an acquisition spree across sectors, buying brands such as JustDial, Netmeds, Zivame (15% stake), and Urban Ladder among others.

similarly, ITC entered the space by buying a 16% stake in the mother-child brand Mother Sparsh. this is part of the ITC Next strategy that will see the company develop more online-first FMCG ventures.

Aditya Birla Fashion, too, is entering the D2C space by setting up a focussed subsidiary. this subsidiary will scout for attractive D2C brands that can be bought and developed.

HUL, which is trying to downplay the D2C competition, has silently begun D2C investments through the PE/VC arm of its parent company Unilever. it invested in skincare startup Plum almost four years ago.

the race to become India’s roll-up commerce giant has just started. by the looks of it, this is going to be a marathon and not a sprint.