what is the national pension scheme (nps)?

What is the National Pension Scheme

the national pension scheme is an investment instrument offered to help you save for your retirement. it is a scheme introduced in 2004 by the government to extend a retirement/pension option to all citizens of india. the returns on investments are generated from market investments and can provide returns from 9-12% per annum.

what are the features of nps?

the national pension scheme comes with the following features and benefits.

● the nps account can be opened either online (enps) or by visiting any designated point of presence.

● any resident indian can invest in nps, but nris can invest only in tier i accounts.

● upon registering, you will be issued a pran (permanent retirement account number).

● you can then open a tier i or a tier ii nps account.

● nps accounts are portable, so you don’t need to open a new one every time you change jobs or cities.

● nps investments offer tax benefits under sections 80ccd and 80cce too.

● amounts invested in the nps account can be withdrawn at the age of 60, or investments can be extended to the age of 70.

what are the tax benefits of nps?

investments in nps can be claimed for tax deductions under section 80ccd of the it act. the benefits that can be claimed are subject to the limit of section 80cce, which is rs.1.5 lakhs in a year. an additional tax benefit can be claimed for investments up to ₹ 50,000 under section 80ccd (1b). this claim is independent of the limit of 80cce of ₹ 1.5 lakhs.

the tax benefits are also available only on tier i accounts and not on tier ii accounts. in fact, there are no tax benefits available on tier ii accounts.

what about withdrawals from nps accounts?

when it comes to withdrawing the investments made in nps accounts, you should know that the tier i account comes with a lock-in period. this lock-in lasts till you acquire the age of 60 years. once you are 60 years old, you can withdraw 60% of the nps account amount as a lump sum. the remaining 40% needs to be used to purchase an annuity. when you withdraw from an nps account, after attaining the age of 60 years, 40% of the amount withdrawn is exempt from taxes.

tier ii accounts don’t have any lock-in periods, and you can withdraw the amount invested in them at any time. the amount invested can also be transferred to the tier i account.

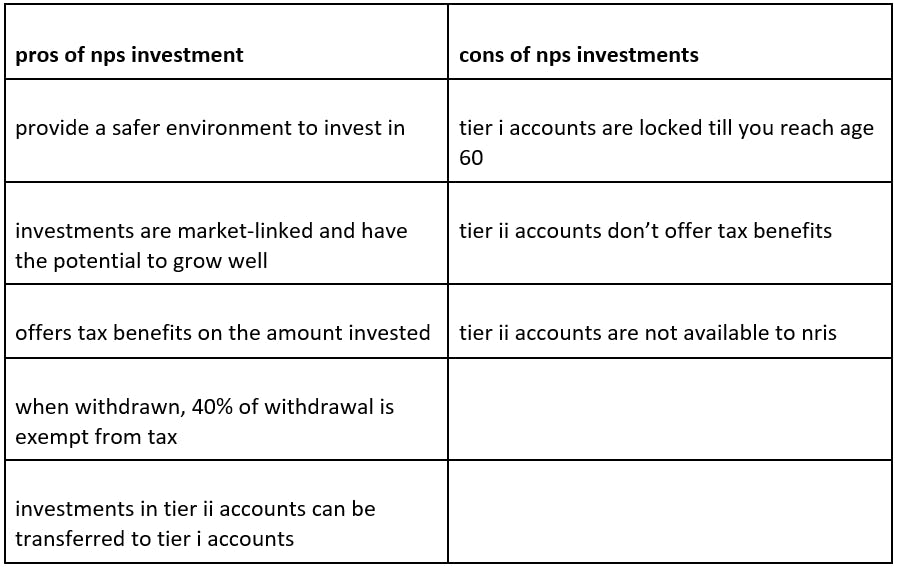

what are the pros and cons of nps?

the national pension scheme is just one of the schemes that the government offers. another scheme that you can invest in is the public provident fund, or ppf, which gives you a fixed interest on your investments. you can also use tools like a ppf maturity calculator, also known as a ppf return calculator, to determine what your investment will grow to in a certain period.