How to calculate EMI in advance and EMI in arrears?

When you borrow a loan, you repay it in equated monthly installments (EMIs) over a specified period of time known as the loan tenure. the EMI payments consist of the principal amount and the interest at a specific rate. EMIs can help you create a balance between your monthly income and expenses. you can find out the right balance between loan amount, loan tenure, interest rate and monthly EMI by using an online EMI calculator created by CRED.

EMI in advance and EMI in arrears are two loan repayment options provided by financial lenders to attract more customers.

What is EMI in arrears?

EMI in arrears, also called the arrears EMI or the standard EMI, is an EMI repayment option where you have to pay EMI at the end of each month over a specified loan tenure. In this scheme, the bank or NBFC disburses the entire principal loan amount minus the processing fee to your bank account without deducting any advance EMI payment. this type of loan repayment option is ideal for those who don’t have sufficient funds to make an advance down payment while purchasing an asset.

What is an advance EMI?

EMI in advance, you can also call it advance EMI, is a type of EMI repayment option where you need to pay the first EMI payment in advance to the lender. in this type of scheme, the principal amount minus the processing fee and the first EMI amount is disbursed to your bank account. the first EMI deducted in advance EMI option consists of only the principal amount and hence it helps in reducing the principal loan amount for the rest of the EMI payments. following the first EMI payment, the rest of the EMIs will consist of both the principal amount and the interest.

How to calculate advance EMI and arrear EMI

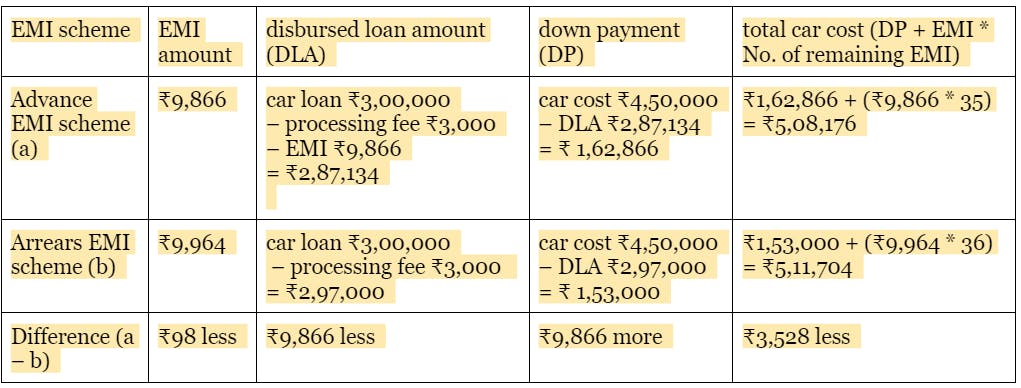

Let's take an example to better understand how advance EMIs and arrear EMIs are calculated and what's the difference between the two. let's assume that you want to buy and need a loan for the same. let’s say the total cost of the new car you want to buy is ₹4.5 lakh, and the car loan amount you want to apply is ₹3 lakh at an interest rate of 12% per annum for a loan tenure of 3 years (36 months) with a processing fee of ₹3,000.

Car on road price: ₹4.5 lakhs

Car loan you applied for: ₹3 lakhs

Loan interest rate: 12%

Loan tenure: 3 years (36 months)

Processing fees: ₹3,000

Note: the table shown above is representative to show you how to calculate advance EMI and arrears EMI. you should call the lender and ask for all the calculations before taking the loan.

Advance EMI vs arrear EMI: which one is better?

Both the advance EMI and arrear EMI options are good but which one is best suitable for you depends on your financial situations. for example, if you have a tight budget, go for an arrears EMI scheme as it will reduce the burden of initial down payment. Whereas if you don’t have any financial constraints, choose to pay advance EMI as it will reduce the principal amount.

You can use the CRED EMI calculator to find out the total cost of your loan for both - the advance EMI and arrear EMI schemes - and choose the one that fits in your requirement the best.

use CRED EMI calculator now