what is the average return on SIP?

systematic investment plans (SIPs) have been in the Indian market for decades now. over the years, SIPs have become one of the best financial tools to generate excellent return on investment and create wealth in the long term.

SIPs offer a simple and disciplined way to create big wealth over time. here are three basic principles that you should follow to create wealth through SIP route:

#1. starting early is the first most important step towards generating wealth through SIP investment. the earlier you start investing, the more return you can expect. since SIPs use the power of compounding, the more your returns, the more you would earn returns on returns.

#2. time plays a crucial role in generating wealth through SIP plans. early contributions are a very significant factor in a SIP investment. this is the reason why a regular SIP offers better returns compared to a step-up SIP.

3#. in order to reap the most benefit of the power of compounding, you should remember two things - firstly, you need to diversify your investment in equity funds to leverage the power of equities; and secondly, you need to ensure that you reinvest the returns through growth options.

average return on SIP investment

when it comes to investment, the first question that comes to the mind of an investor is 'how much return can i earn through this investment'? when it comes to SIPs, even small investments if continued for a long time with discipline and in growth assets like equities can help you generate excellent returns. unlike fixed deposits, the rate of return on investment is not fixed in SIPs.

SIPs help you take advantage of market volatility as SIP units are invested at different prices and the cost keeps getting lower on average over a period. hence, average returns on SIPs are most of the time better than other investment options such as FD returns.

how much can you earn through SIP?

the answer to this question lies in the type of SIP plan you choose. there are different types of SIP plans available in the market. you can choose your type of SIP plan based on your income, expected return, investment horizon and risk appetite. for example, if your investment horizon is short and you don’t want to risk your principal amount, then go for a low risk or balanced SIP plan. the rate of returns may not be too lucrative in conservative or balanced SIP plans but you can rest assured that your invested amount is safe. if you remain invested for say 3-5 years, your average return on SIP can be anywhere between 8-10%.

a well diversified SIP plan is recommended by financial experts to minimize the risk and boost the expected return rate. to earn excellent return on SIP investment, try to keep your investment horizon at least more than 5 years. the longer, the better. Over the years it has been seen that diversified plans have given an average return rate of 13% to 15% in 5 years and more.

those who want to earn a higher return rate can choose to invest in aggressive SIP investment plans. as the name suggests, an aggressive plan invests in aggressively growing companies to create higher capital gains in a shorter span of time. the aggressive growth plans invest highly in equity and equity-related securities of companies that project exponential earnings and revenue potential. these types of investment plans are best to outperform the standard growth rate in the market. however, you should note that since the value of your fund may vary tremendously depending on the volatility in the equity market. hence, the associated risk is always higher in aggressive investment plans.

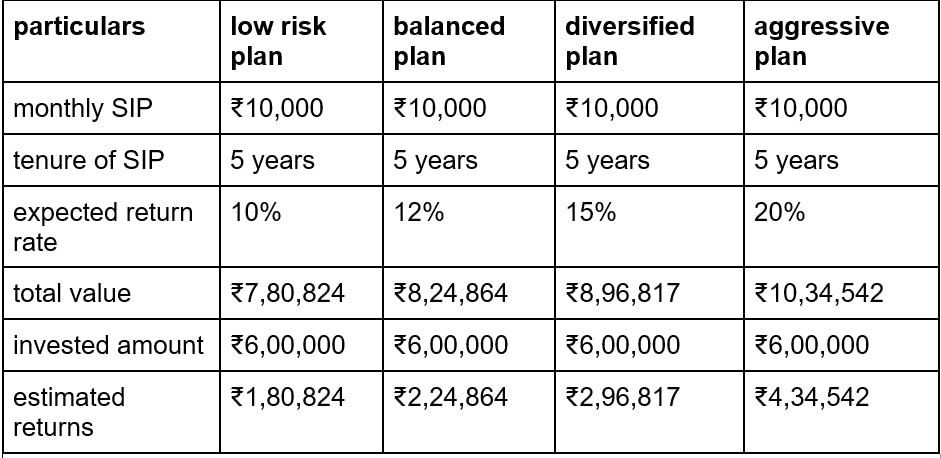

market experts say that on an average, SIPs can give 10-20% return if you invest regularly in growth assets like equities. let's suppose you choose to invest Rs ₹10,000 every month for 5 years through SIP. here is a break up of how much can you earn through different types of SIP investment plans:

note that the table provided above is just an indicative list. you should compare different funds, calculate the risks involved and read extensively the offer document before selecting the right SIP plan for yourself.

you can choose to create your own SIP investment plan through CRED SIP calculator.

how to use the CRED SIP calculator?

CRED SIP calculator is an easy to use free tool that you can use anytime, anywhere to create your own personalised SIP investment plan. follow the steps provided below to use the CRED SIP calculator:

- visit CRED website or app and open the SIP calculator

- set the monthly investment amount

- set the expected annual return rate

- choose the time period (tenure) of your investment

- CRED SIP calculator will instantly display the total value of your investment, along with invested amount and estimated returns

use CRED SIP calculator now to create your own investment plan and start earning.