Difference between CIBIL Report and CIBIL Credit Score

Terms like CIBIL credit report and CIBIL credit score are very common in the financial world, especially when you are about to apply for a credit card or a loan . You may be left confused between the two terms if you are someone who is new to the world of credit. It is critical for you to understand the difference between a CIBIL credit report and a CIBIL credit score as it will help you in your financial journey.

Credit is essential, whether you are an individual or a business. To achieve financial goals like purchasing a home, a car, or opening a business, a person needs credit. Banks and other financial entities offer loans to individuals. However, before extending credit to individuals, banks and lenders need an assurance that the potential borrower will repay the debt they are asking for. To assess the creditworthiness of the borrower, credit score is taken into consideration.

CIBIL is one of the credit reference agencies in the country that calculates the creditworthiness of an individual based on which, lenders and banks make their decision.

Let us understand the difference between a CIBIL Report and a CIBIL credit score in detail.

What is a CIBIL Credit Report?

A CIBIL credit report, often referred to as a Credit Information Report (CIR), is a comprehensive document that contains details about an individual’s current and past loans, credit related information, and other personal data like their PAN number, date of birth, place of residence, gender, and so on. In order to produce a thorough CIBIL credit report, credit bureaus gather credit information from banks, financial institutions, and lenders.

A person’s CIBIL credit report may have the following details:

- Personal information such as name, gender, date of birth.

- Contact information such as addresses (temporary and permanent), mobile numbers, landline numbers, and email addresses.

- Employment information including their income.

- Account information such as number of accounts, type of credits availed, any loan settlement, total overdue amount, any unpaid debt, credit card details, and credit card cancellations.

- Enquiry information made by lenders and banks when an individual applies for any type of credit product.

- CIBIL credit score based on the person’s repayment history and other credit related activities.

So, it can be said that a CIBIL credit report is a detailed document of an individual’s financial history that helps a lender to assess the associated risk if they agree to lend to the potential borrower.

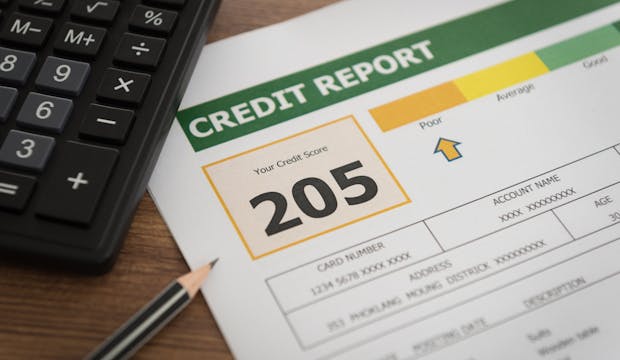

What is a CIBIL Credit Score?

A CIBIL credit score is a three-digit numerical representation of a person's CIBIL credit report based on their credit history. The CIBIL credit score ranges from 300 to 900. The likelihood that a person's credit card or loan application will be approved increases when their CIBIL Score approaches 900. Any score above 750 is a good CIBIL Score and assists lenders in evaluating and accepting your loan application.

What Factors Impact your CIBIL Credit Score?

Your CIBIL credit score is calculated based on a wide array of factors. Not only is the repayment pattern taken into consideration while your credit score is calculated. Listed below are some of the major factors that impact your CIBIL credit score:

- Repayment History

Missing a payment due date or failing to pay your dues on time will impact your CIBIL credit score drastically. Paying on time and regularly shows that you are a responsible borrower and you can manage your personal finances smoothly. While as failing to repay on time denotes just the opposite. This lowers your credibility as a borrower and hence, a few points are knocked off from your CIBIL credit score when you fail to repay in a timely manner. - Mix of Credit Types

Lenders and banks will be more interested in approving your loan or credit card application if they see that you are capable enough to maintain different types of credit. For example, if you have a personal loan, a credit card and an automobile loan, lenders and banks may conclude that you can manage the other loan that you are asking for in a swift manner. Also, having different credit mix on your CIBIL credit report will help it grow over the years. - Credit Utilisation Ratio

Credit utilisation ratio is nothing but how much you spend against the credit limit assigned to you. If the percentage goes over 30, you may have trouble getting your loan application approved. High credit utilisation ratio means you are in need of debt and that will lower your CIBIL credit score. Next time you hit the mall and think of splurging, calculate how much you will be spending so that it doesn’t affect your CIBIL credit score. - Debt to Income Ratio

This is another major factor that impacts your CIBIL credit score negatively. Debt to income ratio is calculated by dividing your expenses including debts by whatever you earn. If your debt is way too high than what you earn – your CIBIL credit score will suffer. Try to keep the ratio as low as possible to help improve your credit score.

A CIBIL credit report and a CIBIL credit score are two entirely different entities. A credit score is a part of the CIBIL credit report. Whereas a CIBIL credit report is the detailed summary of your financial activities. Try to maintain your CIBIL credit score if you wish to receive loan offers at lower interest rates as a bad credit score will attract high interest rate loans.

FAQs Related to CIBIL Credit Report Vs CIBIL Credit Score

What is CIBIL and CIBIL score?

CIBIL stands for The Credit Information Bureau (India) Limited and is one of the credit rating agencies in India. The credit reference agency uses the data provided to them by banks, NBFCs, lenders, and other financial institutions to calculate a score, known as CIBIL credit score. A CIBIL credit score is a numeric representation of your financial behavior.

How can I get CIBIL score from my CIBIL credit report?

Your CIBIL credit report will have the credit score that you need. Download your CIBIL credit report and check your credit score.

What is a good credit score in CIBIL?

If you have a CIBIL credit score of more than 750, it is considered to be a good score. Your CIBIL credit report is regarded as ideal if your score is beyond 750.

What does it mean if my CIBIL credit report shows a score of 1?

If your CIBIL credit report has a credit score of 1, it means you do not have a credit history at all. You can start your credit history by taking out a credit card or a loan. Having a credit history is extremely essential as it helps you build a trust factor with the lenders and banks as you may need credit in the future.