How to Get a Credit Card without a CIBIL Score?

Shopping via credit card is becoming increasingly popular these days. After all, a credit card comes packed with unlimited benefits such as reward points, special deals, and crazy discounts. That explains why hundreds and thousands of credit card applications visit the desk of banks every day. The banks, on the other hand, go through the credit report, CIBIL or credit score, income, and various other things before they approve a credit card application.

Now, out of all the mentioned factors, a CIBIL score or a credit report may not be something that you are relevant to. And you must be worrying about whether a no credit history or a bad CIBIL score can hinder your chances to get a credit card. Well, calm down. You can still acquire a credit card subject to a few conditions. Read on to know how.

What is a CIBIL Score?

CIBIL score is nothing but an indicator of an individual’s creditworthiness. It is a three-digit number that is determined on the basis of your credit history found in the Credit Information Report that comprises records related to your loan repayments or your credit card payment.

Whenever you approach a bank for a credit card, the first thing they will do is review your CIBIL score and credit report to analyze if you can afford a credit card and make timely payments.

What is the ideal CIBIL score for acquiring a credit card?

If you want to acquire a credit card, make sure that your CIBIL or credit score is above 700. Remember, a CIBIL score between 700-900 is considered to be a good number and can act as a catalyst to instill confidence in the lender thereby proving your creditworthiness.

So now, let’s take a look at how you can acquire a credit card with a low or no CIBIL score at all.

Go for secured credit cards

Since you do not have a credit history or a bad CIBIL score, the bank may offer you a secured credit card. Sounds confusing right? But secured cards have been here for a while now, so you need not worry. Secured credit cards are given against fixed deposits and get approved in seconds contrary to a month-long approval process involved in acquiring a normal credit card.

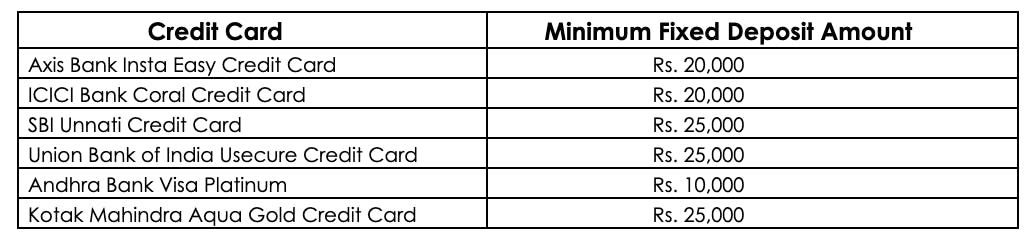

Here is a list of credit cards that can be availed against fixed deposits:

Show evidence of your income

If you work in a good company and earn adequately, you can acquire a credit card based on that, even if you have a low or no CIBIL score. All it takes is evidence of your income to prove to the bank that you are capable enough to pay off your bills on time.

Obtain a credit card against a savings account

Credit cards against savings accounts are currently offered by a few central banks. In order to obtain a credit card in conjunction with your savings account, you will be required to deposit a certain amount to the bank and you are good to go.

Get yourself an additional credit card

This is yet another way by which you can get your hands on a credit card with a bad or no CIBIL score at all. But first, let’s learn what an additional credit card is. An add-on credit card has the same features as the primary credit card and can be shared by the family members of the main cardholder. Not only does it eliminate the need of having multiple cards in a family, but also can be utilized during financial emergencies, despite one having a bad CIBIL score.

How to acquire a credit card in India?

If you hold your account in a particular bank, approach the same bank for your credit card. Almost all banks in India offer a wide variety of credit cards to choose from that come with different benefits and rewards.

- When you apply for a credit card, the card issuer will ask for your credit report which involves your CIBIL or credit score.

- Once you have applied for the credit card, you need to be patient as the approval process can take a couple of days or sometimes weeks.

- The credit card issuer will check your creditworthiness to find if you can actually afford a credit card and pay back the bills on time.

- The bank reps may call you several times or even do a physical verification to determine your creditworthiness. When they are sure about your ability to return the amount borrowed on time, you will be given a credit card with a credit limit as per your creditworthiness.

- However, if the bank finds a discrepancy in your loan application, he may put your approval on hold. They will ask you to reapply after a few months when your CIBIL or credit score has shown some signs of improvement.

Conclusion

There’s no denying the fact that a good credit report or a high CIBIL score is important for obtaining a credit card. But there’s always another way out. And in this case, you can use the above mentioned ways to get the credit card you need. However, don’t spend anything beyond your ability to pay. If you overspend and then fail to repay it, things might turn upside down. So use your credit card wisely.