Mistakes that Negatively Impact your CIBIL Credit Score

In your financial life, CIBIL credit score plays a crucial role. If you have a good CIBIL credit score, you will be able to get any type of secured or unsecured loans at the best interest rates. When applying for a credit card, a home loan, a business loan, a personal loan, or any other type of credit, the CIBIL credit score has a significant impact.

If you plan to take out a loan, keep in mind that your CIBIL credit score will play a significant role in evaluating your loan eligibility. Furthermore, your CIBIL credit score has an impact on more than simply your eligibility; a good CIBIL credit score might help you get a loan with better terms, such as lower interest rates, than those with a lower CIBIL credit score.

As a result, it is critical that your CIBIL credit score remains in good standing. There are numerous instances or common blunders that result in a drop in your CIBIL credit score. Many times, your CIBIL credit score is hurt without your knowledge.

Here are a few common mistakes you should avoid making in order to boost your CIBIL credit score:

1. Irregular repayment history

An irregular credit repayment history is one of the primary reasons that you have a negative impact on your CIBIL credit score. It reveals your failure to pay loan EMIs and credit card amounts. It can take months or even years to repair or restore your CIBIL credit score. It is advised that debts be paid off as soon as possible and on time.

2. Multiple credit card or loan applications

When you apply for any type of credit, potential lenders and financial institutions perform a hard credit check on your report. If you apply for credit multiple times within a short period, your credit record will reflect this. A high number of hard credit inquiries in a short time frame has a negative impact on your CIBIL credit score. Your CIBIL credit score decreases with each application. Lenders will consider you as a credit-hungry individual and may refuse to extend credit to you.

3. Having a high credit utilisation ratio

Your CIBIL credit score is influenced by your spending habits. You become a risky borrower if you rely on credit too much. Lenders believe that a borrower with a high credit utilisation rate will have trouble repaying the loan. For example, your credit usage ratio (CUR) will be over 50% if you have a credit card with a limit of Rs 1 lakh and spend almost Rs 50 thousand per month. Your CIBIL credit score will suffer as a result of this. Lenders prefer a CUR of less than 30% because it is regarded as an indication of budgetary responsibility.

4. Errors on CIBIL credit report

Customers who take out loans or use credit cards and make payments believe that their CIBIL credit score is solid and under control. However, there may be some flaws or inaccuracies on your CIBIL credit report that are affecting your CIBIL credit score. It is critical to check your CIBIL credit report on a regular basis, and even more so before applying for a loan or credit card. Credit bureaus may make mistakes because lenders may fail to send updated information.

5. Debt settlement

When you are short on cash and need to make a quick decision, the first thing that comes to mind is to either postpone or pay only the minimum amount due on your credit card. In both of these scenarios, your debt will accumulate, and you may find yourself in a debt trap. Many borrowers choose to settle at this time by paying a portion of the entire outstanding dues, which includes principal and a percentage of the interest owed to the lender. However, doing so lowers your CIBIL credit score and makes it more difficult to get credit in the future.

6. Closing active credit cards

Closing your oldest account can reduce the length of time your credit accounts have been open, perhaps lowering your CIBIL credit score. Closing old accounts will also reduce your total available credit, causing your credit usage ratio to fluctuate. You should not close your previous accounts since they demonstrate their long relationship with the lenders by demonstrating that they have maintained and handled accounts for a longer period of time.

Here are a few tips to increase your CIBIL credit score; however, keep in mind that these approaches may not work overnight. It takes time to improve or restore your CIBIL credit score.

a) Make your monthly credit card payments on time.

b) Maintain a healthy mix of secured and unsecured debt.

c) Make careful use of the credit usage ratio.

d) Correct the mistakes on your CIBIL credit report.

e) After an application has been rejected, do not apply for a loan or credit card right away.

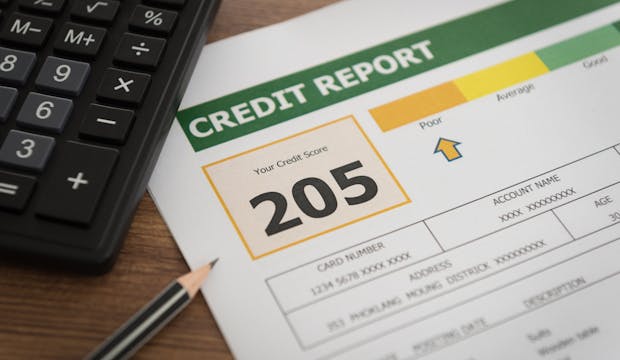

A credit score, or CIBIL credit score, is a numerical representation of your creditworthiness. It ranges from 300 to 900, and you should strive to get your CIBIL credit score near to 900. With a higher CIBIL credit score, you will be in a better position to secure a good interest rate on a loan or when applying for a credit card. People with a CIBIL credit score of 750 and above are more likely to be approved for a loan or given a credit card by most lenders, including banks and non- banking financing companies (NBFCs). As a result, in order to keep a high CIBIL credit score, you must use your credit card responsibly.