meet Jack Bogle

meet Jack Bogle

meet Jack Bogle

“if a statue is ever erected to honor the person who has done the most for american investors, the hands down choice should be Jack Bogle,” Warren Buffett wrote in a letter to investors in 2017.

the stock market lauds the likes of Buffet for his investment philosophy and acumen but the oracle of Omaha looks up to Bogle as his hero.

so, who is Jack Bogle?

back in time

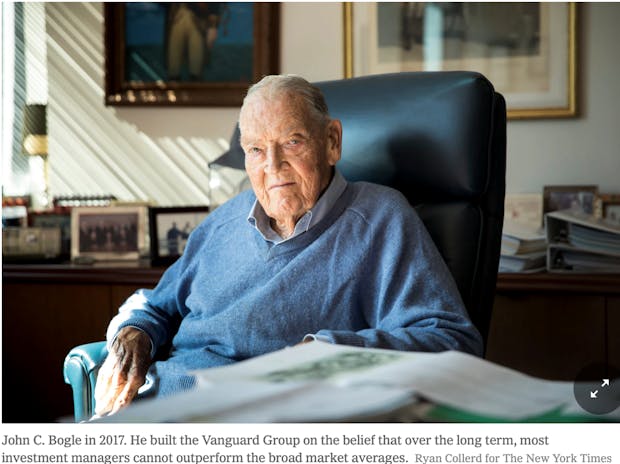

born in New Jersey in 1929, Jack C. Bogle, commonly referred to as “Jack” Bogle founded the Vanguard Group, which currently is the largest provider of mutual funds with about $7 trillion in global assets under management.

unlike celebrated stock pickers like Buffett, Bogle had a contrarian and revolutionary view on investing.

“don't look for the needle in the haystack. Just buy the haystack,” Bogle said. it roughly translates to instead of stock picking, one should just buy the whole market. with this view Bogle founded the Vanguard Group in 1975. in the following year he launched the Vanguard 500 fund, which would track the S&P 500 index, creating the world’s first index fund and, eventually, disrupting the mutual fund industry forever.

“the two greatest enemies of the equity fund investor are expenses and emotions,” Bogle wrote in The Little Book of Common Sense Investing. this was a critique on actively managed funds which, despite charging a hefty fee to their clients, would still find it difficult to consistently beat the returns of the broader market.

in the initial days , Bogle was ridiculed by his peers because they thought that he would opt for such a boring form of investment. fast forward to now and it is one of the more popular forms of growing wealth.

in the US, passive funds make up over 50% of the entire mutual fund industry assets under management (AUM). it’s not just the US, this seems to be an option Indians are choosing as well.

according to AMFI, net AUM of index funds stood at INR15,359 crore at the end of January, almost double the AUM at the end of January 2020.

“a lot of Wall Street is devoted to charging a lot for nothing. he charged nothing to accomplish a huge amount,” Buffett said after Bogle passed away in 2019 at the age of 89.

Bogle changed the game and showcased that investing does not have to be complex or costly as long as one invests with common sense.