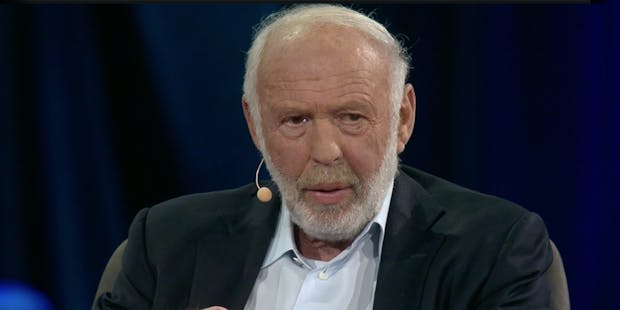

who is Jim Simons?

who is Jim Simons?

who is Jim Simons?

who’s the most successful investor of all-time? most will say it's Warren Buffett. after all, he is the richest one out there. but success is subjective.

if we talk purely in terms of returns generated over the years, then Buffett’s Berkshire Hathaway is far behind a mathematician called Jim Simons.

Simons, the founder of hedge fund Renaissance Technologies, is hailed by many to be the greatest investor ever. he is also the subject of the 2019 book by Gregory Zuckerman, The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution. an apt title for someone like Simons, who used his skills in mathematics to make billions from the stock market.

he may be a big name today, but Simons, now 83 years old, had humble beginnings.

the origin story

son of a shoe businessman, Simons mopped floors as a teen before getting admission in MIT for a bachelor's degree in mathematics. he then got his PhD from the University of California, Berkeley. after which he went on to help the National Security Agency break codes during the cold war era.

Simons spent a considerable amount of time in academics before pivoting to trading.

in 1978, at 40, Simons left academia and started a hedge fund called Monemetrics, which later got renamed to Renaissance Technologies in 1982.

at first, he didn’t apply his skills in math to his hedge fund. but in 1988, Simons decided to solely rely on quantitative analysis to decide which trades to enter. and thus the Medallion fund was formed.

the big move

medallion is famed for having the best track record on Wall Street. It has generated an average annual return of 66% before fees. even after charging hefty investor fees, the fund is able to generate an annual return of 39% since its inception.

no other celebrated fund manager, be it Buffett, George Soros or Peter Lynch, comes close to such a performance.

"past performance is the best predictor of success," Simons once said.

Medallion relies on algorithms, which churns huge volumes of market data in order to shortlist profitable trade opportunities. in order to execute this strategy, Simons hired physicists, mathematicians, and computer scientists and eventually unleashed a quantitative revolution on Wall Street. the catch with the Medallion Fund is that it is available only to Renaissance's owners and employees.

in 2020, the Medallion fund generated 76% returns, which makes it the third best year in the fund's history. the other two years, which fared better than 2020, were 2000 and 2008, where the fund saw 98.5% and 82.4% gains, respectively.