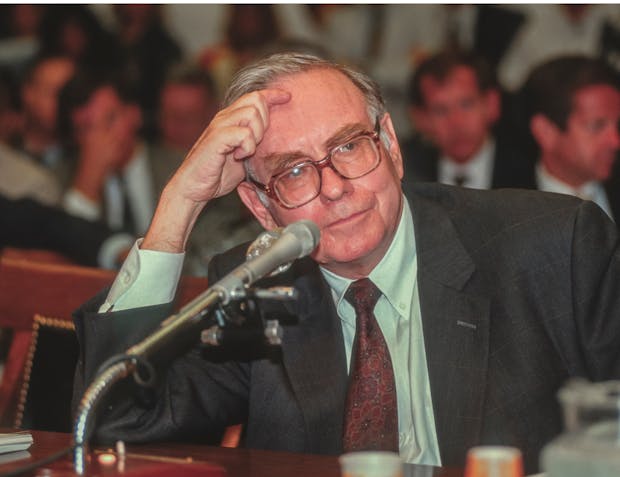

Warren Buffet’s Big Miss

Warren Buffet’s Big Miss

Warren Buffet’s Big Miss

Warren Buffett once advised to "never invest in a business you cannot understand" and he himself followed his advice when it came to tech stocks.

“we will not go into businesses where technology which is way over my head is crucial to the investment decision,” Buffett once said. “i know as much about semiconductors or integrated circuits as i do of the mating habits of the chrzaszcz [a Polish beetle],” he wrote in 1967.

for years, Buffett stayed invested in the businesses he understood such as razors, soda, and insurance, but he stayed away from technology firms, which while being growth stocks, were prone to disruption and hence had an uncertain future.

regrets, he has some

like any investor in the market, Buffett has had his share of hits and misses as well. In a shareholder meeting he said he regretted not investing early in Google. “our biggest tech failure was missing Google,” he said.

so, what made him change his mind and invest heavily in the likes of Apple and Amazon?

Buffett says that Apple is more akin to a consumer stock then a tech stock and on Amazon he said that the company “far surpassed anything i would have dreamt could have been done. because if I really felt it could have been done, i should have bought it.”

Buffett gave the credit for these investments to Todd Combs and Ted Weschler. the duo invested independently and were speculated to be the frontrunners to succeed Buffet as the chief executive of Berkshire until it was finally announced earlier this year that Greg Abel would be the new CEO.

while Berkshire finally warmed up to tech stocks but unlike a typical value investor, who would have recognized the intrinsic value of a stock before the market and invested at lower valuation, these investments came at a very late stage in the life cycle of these firms.

as the world moved from the old, asset-heavy economy to a new, asset-light one, value investors were late to adapt and understand this shift and as one enters a world where platform economies are the dominant force, value investors are again at a crossroad where they either adapt to such change or miss out on it.