the Peter Lynch way of investing

the Peter Lynch way of investing

the Peter Lynch way of investing

Peter Lynch lost his father when he was 10. at the age of 11, he started working as a caddy in a golf club. on the golf course he would hear the wealthy talk about stocks and saw them rise in value.

a curious Lynch took a fancy to the stock market but had no money to invest.

he made his first investment as a college student while doing a report on the air cargo industry and bought $300 worth of stocks of Flying Tiger airlines as the Vietnam War had begun and the airline had to fly a lot of stuff to Vietnam.

even as a youngster, Lynch knew the exact reason he was buying the airline firm and paid for his graduate school from his investment in Flying Tiger.

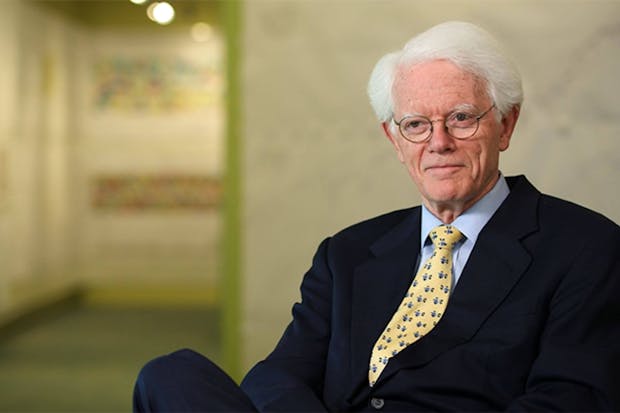

Lynch’s investment philosophy has changed little since and he is one of the most celebrated investors in history. he took over as fund manager of the Magellan Fund at Fidelity in 1977 at the age of 33 and ran it for 13 years before retiring in 1990 at 45. during his tenure, the fund was one of the best performing in the world and gave an annual return of 29.2%, 2x of what S&P 500 generated in the same period.

Lynch is what is called a “story” investor and his philosophy is simple: “invest in what you know”.

he believes that the more one knows about a company and understands its business and competitive landscape, the better are the chances of finding a good story stock. it’s better to put money in "motel chains rather than fiber optics," he says.

but stories can be deceptive as well. so, how does one avoid potential wealth destroyers?

lessons to remember

Lynch has four suggestions on how not to get your fingers burned while picking alluring ‘stories’ and advises one avoid:

- hot stocks in hot industries.

- companies, especially small firms, with big ambitions that have not yet been proven.

- companies engaged in what Lynch terms as diworsification, which is profitable companies engaged in diversifying acquisitions.

- businesses where a single client would account for over 25% to 50% of total revenue.

while one might find a good ‘story’, it is more important to hold on to it for the long-term.

“in the stock market, the most important organ is the stomach. it's not the brain,” Lynch says and having the conviction to hold on to an investment when the going gets tough is what will eventually generate wealth.